Bekannt aus

Smarte Vermögensgestaltung auf höchstem Niveau

Die Finanzmärkte entwickeln und verändern sich stetig. Vor allem in den vergangenen Jahren hat die Volatilität der Finanzmärkte extrem zugenommen. Für Laien erscheint es daher unmöglich, das eigene Vermögen in den komplexen Strukturen der Finanzmärkte selbst zu verwalten. Ein professionelles Management hilft dabei, den Überblick zu wahren und das Geld profitabel anzulegen.

Dank unserer langjährigen Erfahrung genießen Sie mit uns die Sicherheit, stets eine kompetente Begleitung zu erhalten. Eine zielführende und individuelle Finanzberatung bedeutet für uns einen intensiven Dialog zwischen Anleger und Vermögensgestalter als Basis für eine erfolgreiche Kapitalanlage und eine langfristige Zusammenarbeit.

Gerade in unsicheren, bewegten Zeiten mit einem volatilen Aktienmarkt bedeutet eine breite Streuung von verschiedenen Anlageklassen die beste Grundlage für eine stabile Wertentwicklung Ihres Vermögens. Deswegen legen wir den Fokus auf Vermögenswachstum und Vermögenssicherung, um bei Aktienmarkt-Einbrüchen mögliche Verluste deutlich zu reduzieren.

Die finale Anlagestrategie wird dabei ganz nach Ihren persönlichen Risikovorgaben, Ihrer Lebenssituation und Ihren Zielen erarbeitet. Wir verwalten Ihr Vermögensdepot aktiv, intelligent und persönlich.

Daniel Charles Bossenz

Geschäftsführer der Smarter Finance 24 GmbH

Unsere Investment-Philosophie

Diversifikation

Maximale Risikostreuung durch globale Multi-Asset-Allocation von illiquiden Anlagen, wie Immobilien und Sachwerten bis hin zu liquiden Anlagen wie Fonds, ETFs, Edelmetallen oder Anleihen.

Transparenz

Sie erhalten einen persönlichen Online-Zugang über moderne Softwarelösungen. Regelmäßige Berichte und Direktzugriff auf Ihre Depots geben Ihnen maximale Kontrolle und volle Transparenz.

Nachhaltig

Nachhaltigkeitskriterien spielen bei unseren Marktanalysen eine immer größere Rolle. Sie ergänzen die Grundpfeiler unserer Kapitalanlage aus fundierter Analyse und konsequentem Risikomanagement.

Niedrige Kosten

Wir achten auf niedrige Service- und Verwaltungskosten durch die Beimischung von Exchange-Traded Funds (ETFs) und strategische Partnerschaften zu alternativen Investmentprodukten. Damit bleibt ihr Finanzkapital erhalten.

Sicherheit

Wir konzipieren unsere Portfolios stets mit einer Absicherungsstrategie. Diese dient vor allem als Vorsorge für Krisen und extreme Marktschwankungen. Geben unsere Experten grünes Licht, so lösen wir die Sicherheitsstrategie teilweise oder vollständig aus.

Service

Sie erhalten eine persönliche und professionelle Finanzberatung sowie eine regelmäßige Anpassung und dauerhafte Betreuung Ihres Vermögenskonzepts. Bei Fragen stehen unsere Experten Ihnen stets zur Seite.

Ganzheitliche Vermögensverwaltung

Niedrige Zinsen und steigende Inflation sind die neue Normalität. Bewährte Sparformen lohnen kaum mehr, Kapitalmärkte zeigen sich volatil und Immobilien bleiben teuer. Traditionelle Anlageansätze von Banken, Sparkassen und Vermögensverwaltern münden oft in subjektive Managementstrategien mit erhöhten Kosten. Hinzu kommt eine für Laien unübersichtliche Produktlandschaft. Das Umfeld für den persönlichen Vermögensaufbau gestaltet sich anspruchsvoller denn je.

Ihre persönlichen Wertvorstellungen und Ziele bestimmen den roten Faden durch Ihr Leben. Dazu muss auch Ihre Geldanlage passen: mit einer sinnvollen Geldanlage und einer Anlagestrategie, die Sie nachvollziehen können. Legen Sie dafür Ihr Vermögen in gute und vertrauenswürdige Hände, die es umsichtig und verantwortungsvoll verwalten. Wir stehen für professionelle und individuelle Finanzberatung.

Vermögensberatung

Wir bieten eine professionelle Anlage- und Vermögensberatung und stehen jederzeit an Ihrer Seite. Sie behalten die volle Kontrolle über Ihre Vermögenswerte und bestimmen die Richtung. Wir verfügen über ein umfassendes Know-how und behalten auch in turbulenten Marktphasen den Überblick.

Vermögensplanung

In der Vermögensplanung (Wealth Planning) betrachten wir neben Ihrem Wertpapierdepot oder Ihrem Immobilienbesitz den Status quo Ihres gesamten Vermögens. Dafür beleuchten wir unterschiedliche Lösungsszenarien, um Ihre Vermögens- und Lebensziele zu erreichen.

Vermögenssicherung

Durch unsere Sicherungsstrategien und Absicherungskonzepte schützen wir Ihr Vermögen vor kurz- und mittelfristigen Marktschwankungen, staatlichem Zugriff oder vor unvorhersehbaren Risiken.

Steuerreduzierung

Wir unterstützen Privatpersonen, Unternehmer und Firmen, ihre Vermögenswerte möglichst steueroptimiert und zugriffssicher anzulegen. Gemeinsam mit unseren Steuerexperten konzipieren wir steueroptimierte Vermögenskonzepte.

Bankenunabhängige hochsichere Verwahrung von Edelmetallen

Das Einzige, was heute sicher ist, ist die Unsicherheit! Wir leben in einer Zeit, in der Anleger kaum noch Zinsen auf ihr Sparguthaben bei der Bank erhalten. Staatsanleihen haben ebenfalls an Sicherheit und Rendite verloren, die Inflation frisst alle Geldwerte und vernichtet sie schleichend. Eine Zeit, in der die als sicher geglaubten Lebens- und Rentenversicherungen ihre zugesagten Renditen nicht mehr erwirtschaften, die Garantieverzinsung gegen Null geht und bei vielen Anlageprodukten und Beteiligungen die Risiken die Chancen weit übersteigen.

Als kompetente Vermögensgestalter arbeiten wir mit sicheren, steueroptimierten Investmentlösungen. In diesem Zusammenhang kooperieren wir mit einem speziellen Rohstoffdepot in der Schweiz und verwahren hier hauptsächlich die Gold- und Silberinvestments unserer Kunden.

Gold war immer wertstabil und wird es auch in Zukunft bleiben. Schon immer waren die Menschen bereit, einen hohen Preis für das glänzende Edelmetall zu bezahlen. Im Gegensatz zu den heutigen ungedeckten Papiergeldwährungen sind Gold und andere Edelmetalle als Sachwerte zum realen Vermögenserhalt nach wie vor hervorragend geeignet.

Im Video erfahren Sie mehr über unseren Partner SOLIT:

Unser Versprechen:

- Sicherer und bequemer Direkterwerb Ihrer physischen Edelmetalle (Gold, Silber, Platin, sowie Diamanten)

- Segregierte und bankenunabhängige Einzelverwahrung Ihrer Edelmetalle an internationalen Standorten

- Mehrwertsteuerfreier Kauf von Silber, Platin und Palladium bei Lagerung in Schweiz

Wir kombinieren für Sie das Beste aus verschiedenen Anlageklassen

Alle Investitionen haben Ihre Vor- und Nachteile oder bergen bestimmte Risiken. Verschiedene Vermögenswerte reagieren jedoch unterschiedlich auf die jeweiligen Umstände. Auch wir können nicht in die Zukunft schauen, aber auf Grundlage von Daten aus der Vergangenheit wissen wir, was auch in einem Worst-Case-Szenario noch funktionieren kann.

- Alle

- Emerging Markets

- Gesundheitswesen

- Immobilien

- Konsumgüter

- Nachhaltig

- Rohstoffe

- Technologie

- Zukunft

Künstliche Intelligenz

Robotik

Nachhaltige Landwirtschaft

Immobilien

Windkraft

Weltraumtechnologie

Gold

E-Mobility

Medizintechnik

Lithium

Industrierohstoffe

Wasser

Agrarsystemtechnik

Gebrauchs- und Verbrauchsgüter

Silber

REIT Fonds

Gewerbeimmobilien

Fossile Energie

Lebensmittel

Gesundheitswesen

Solar

Gaming

Getränke

Emerging Markets

Luxusimmobilien

China

Computer Chips

Blockchain

Künstliche Intelligenz

Diamanten

Digitales Immobilien-Investment

Industrie 4.0

Cybersecurity

Lieferketten

Biotechnologie

Anlageberatung auf höchstem Niveau

Mit unseren Multi-Asset-Strategien kombinieren wir verschiedene Vermögenswerte, um bei einer überdurchschnittlichen Anlagerendite maximale Sicherheit zu erreichen. Eine ausgewogene Mischung aus Aktien, Anleihen, Edelmetallen, Immobilien, Sachwerten, alternativen Anlagen und Barmitteln ist eine Formel, mit der Sie in guten Zeiten Ihre Ziele erreichen und in schlechten Zeiten den Verlust begrenzen.

Am Ende steht der Dialog zwischen Anleger und Anlageexperten, um ein Anlageportfolio zu gestalten, das Ihren Vorstellungen, Werten und Zielen entspricht.

Ein Auszug aus unseren Musterdepots

Dynamisch nachhaltiges Portfolio

Breite Streuung in umweltfreundliche, nachhaltige und soziale Investmentfonds / ETFs. In Absprache mit unseren Kunden können ökologische, soziale und ethische Kriterien genau definiert werden.

- 70% Nachhaltige Fonds / ETFs

- 10% Immobilien

- 5% Sachwerte

- 15% Beimischung

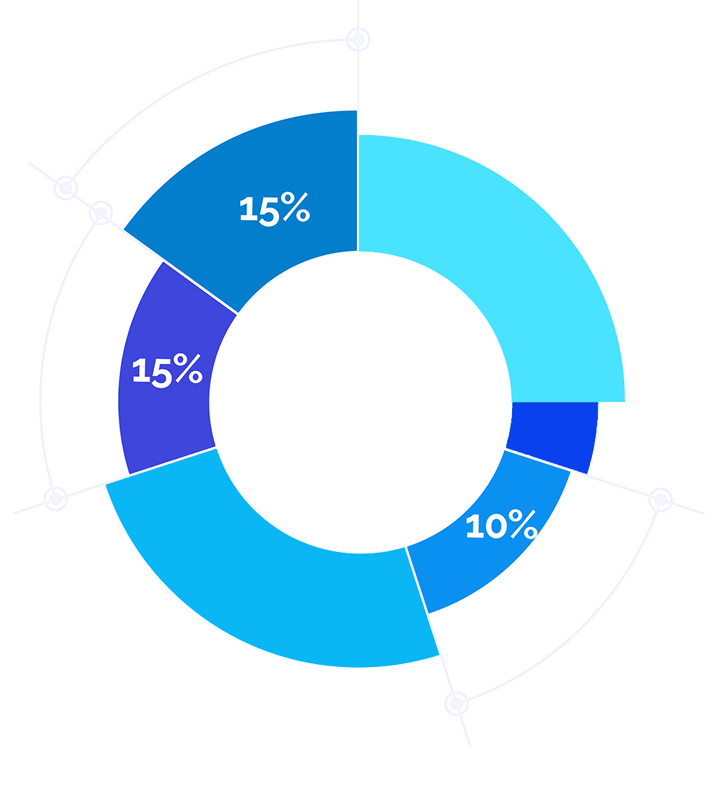

Stabiles Krisenportfolio

In diesem Portfolio setzen wir auf Gold, Silber, und Palladium, um stürmische Zeiten unbeschadet zu überstehen. Short ETFs, ETFs von Goldminen können je nach Situation an den Märkten beigemischt werden.

- 15% Physische Edelmetalle

- 15% Immobilien

- 10% Sonstige Sachwerte

- 60% Beimischung konservative Fonds / ETFs

Innovatives Zukunftsportfolio

Dieses Portfolio eignet sich für langfristig orientierte Anleger und legt den Fokus auf Technologie und Megatrends. Mithilfe von Spezialfonds / ETFs investieren wir vorwiegend in Robotik, Big Data und Künstliche Intelligenz.

- 25% Innovative Fonds / ETFs

- 10% Globale Aktienfonds

- 5% Unternehmensbeteiligungen

- 60% Beimischung alternative Investments

Grafiken designed by katemangostar

Professionelle Finanzberatung

Millionen Euro zu verwaltendes Vermögen

Zufriedene Kunden

%

Nachhaltig, wenn Sie es wünschen.

verschiedene Investmentmöglichkeiten

Allgemeine Fragen rund um Smarter Finance

Wir arbeiten bedarfsorientiert, um Ihnen stets eine optimale Beratung zu bieten. Unsere Anlageempfehlungen als Ihr Vermögensgestalter orientieren sich ausschließlich an der Wertentwicklung Ihres Kapitals. So haben Sie beispielsweise die Möglichkeit, Ihr Depot jederzeit kostenneutral an veränderte Lebensumstände anzupassen.

Gerne unterstützen wir Sie mit einem intelligenten Anlagemanagement, mit dem Sie Ihre Rendite steigern und gleichzeitig Ihr Risiko minimieren.

Für was steht Smarter Finance?

Der Name von Smarter Finance, steht für die Kombination aus einem digitalen, modernen Ansatz mit einer intelligenten vorausschauenden Anlagestrategie.

Welche Anlagesumme muss ich als Kunde mitbringen?

Die Mindestanlagesumme sollte ca. 100.000 Euro betragen, damit wir eine maximale Streuung Ihres Portfolios erreichen können. Dabei muss das Kapital nicht sofort zur Verfügung gestellt werden. In der Regel arbeiten wir mit einer Ansparphase von 8 bis 16 Monaten je nach Marktlage. Das bedeutet, dass ihr gesamtes Kapital erst nach abgeschlossener Ansparphase vollständig investiert ist.

Wie kann ich die Entwicklung meines Portfolios verfolgen?

Jeder Kunde erhält einen persönlichen Zugang zu seinen Depots über unsere Investment-Portale (oftmals auch inklusive mobile App). Hierüber können Sie die Wertentwicklung sowie die Zusammensetzung Ihres Portfolios jederzeit und von überall auf der Welt verfolgen – ganz bequem per Computer, Tablet oder Smartphone. Zudem erhalten Sie einmal im Quartal ein umfassendes, schriftliches Reporting zu dem jeweiligen Berichtszeitraum. Steuerbescheinigungen werden vom jeweiligen Anbieter automatisch erstellt.

Warum bieten wir keine Einzeltitelselektion an?

Wir blicken auf spannende Zeiten. Die Welt ist im Wandel und die kurz- bis mittelfristigen Aussichten sind schwer einzuschätzen. Genau deshalb empfehlen wir eine maximale Streuung der Investments. Wir empfehlen vorwiegend Aktienfonds bzw. ETFs mit einer breiten Streuung, die einzelne Aktientitel nicht bieten können.

Habe ich direkten Zugriff und Einfluss auf meine Anlagen?

Im Rahmen unserer professionellen Vermögensberatung sind wir stets bestrebt, im Dialog mit unserem Kunden zu stehen. Ihre gewünschten finanziellen Ziele und Wünsche und Ihre Flexibilität stehen bei uns im Vordergrund. Bei allen Produkten behalten Sie stets volle Kontrolle. Die Depots laufen auf Ihren Namen und Sie können auf Wunsch sämtliche Handlungen in Eigenregie ausführen. Wir stehen als Berater immer an Ihrer Seite und verfügen über einen Sichtzugriff auf alle betreuten Depots, um eine ganzheitliche Begleitung zu gewährleisten.

Wie erfolgt die Zusammenstellung meiner Anlage?

Das Anlageuniversum richtet sich nach der von Ihnen gewählten Produktausprägung. Bei der fondsgebundenen Vermögensbetreuung investieren wir Ihr Kapital hauptsächlich in ETFs und aktiv gemanagte Fonds. Zur weiteren Diversifikation können Edelmetalldepots, Immobilieninvestments oder alternative Anlageprodukte zum Einsatz kommen, sofern Sie diese als Beimischung wünschen.

Wie kann ich meinen Anlagebetrag anpassen?

Sie haben volle Kontrolle über Ihre Einzahlungen. Erhöhungen des Anlagebetrags, sowie Reduzierungen bis zu der Mindestanlagesumme sind jederzeit möglich. Empfohlen ist vor jeder Anpassung der Anlagesummen ein kurzes Gespräch mit einem unserer Berater. Sie haben aber auch die Möglichkeit, Sparpläne selbstständig über das jeweilige Online-Portal zu reduzieren, auszusetzen oder zu erhöhen.

Moderne Lösungen für unsere Kunden

Digitale Vermögensverwaltung

Mit unseren Softwarelösungen können Sie alle Ihre Vermögenswerte an einem Ort verwalten. In Dashboards und Diagrammen erhalten Sie eine anschauliche Darstellung Ihrer Vermögenswerte.

Die persönliche und smarte Finanzberatung durch unsere Experten ist stets nur einen Klick entfernt - ob über Telefon, Videocall oder persönlich.

Mobile Lösungen für volle Kontrolle

Ob Kurse oder Nachrichten rund um Immobilien, ETFs, Edelmetalle und Aktienmärkte. Mit unseren Apps haben Sie zukünftig alles zentral im Blick – und das nicht nur in Ihren eigenen vier Wänden, sondern durch Apps sogar jederzeit.

Sicherheit

Die Sicherheit Ihrer Daten liegt uns am Herzen. Datensensible Bereiche wie das Dashboard sind zu Ihrer Sicherheit zusätzlich mittels Fingerabdruck bzw. PIN-Code vor unrechtmäßigen Zugriffen geschützt.

Digital überall bestens beraten!

Unsere digitale Beratung können Sie aus ganz Deutschland in Anspruch nehmen, z.B. Berlin, Leipzig, München, Köln oder Stuttgart. Wir beraten auch internationale Kunden, Institutionen oder Expats in Deutschland.

Fragen kostet nichts! Also fragen Sie uns unverbindlich für ein kostenloses Erstgespräch an. Überzeugen Sie sich gerne von unseren Bewertungen und machen Sie sich Ihr eigenes Bild.

Wir denken anders. Wir beraten anders.

Höchste Bewertungen auf

WhoFinance

ProvenExperts

Smarter Finance 24 GmbH

Josef-Orlopp-Straße 46

10365 Berlin

Deutschland

0800 267 73 69

Schicken Sie uns eine Nachricht

Bitte tragen Sie hier Ihre Kontaktdaten ein. Wir melden uns in Kürze bei Ihnen mit Terminvorschlägen für ein unverbindliches und kostenloses Erstgespräch.